It also allows you to access PayPal Working Capital, which is a business loan with a fixed and affordable fee.Ġ2. There are several ways to avoid PayPal fees as a business.īy setting up a business account through PayPal you will have reduced fees. Markup Fee: All other entities involved in the transaction through the network receive a portion of the sale.įees can be avoided as easily as they are charged.Assessment Fee: The card network associated with the cardholder (Visa, Mastercard, etc.).

Paypal transaction fee percentage plus#

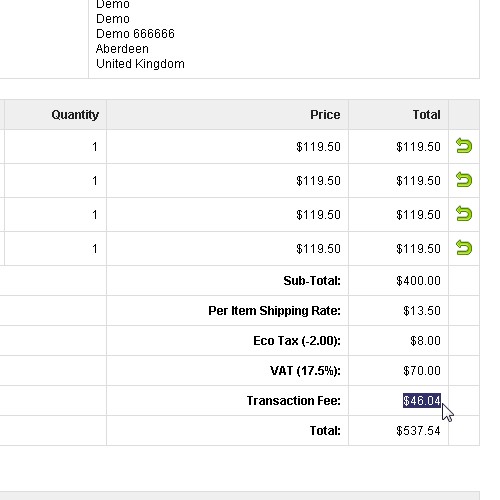

Interchange Fee: A percent of the sale amount determined by the issuing bank plus a fixed transaction fee.When a transaction processes through PayPal, the following fees occur: The parties that complete the interchange are the issuing bank, the credit card association, the merchant bank, and the payment processor. Everyone involved in the transaction receives a percentage of the sale, which is the “ interchange“. For companies in the USA, their fee is 2.9% + $0.30 per transaction. PayPal combines different fees and add their own on top. The graphic below shows the breakdown of fees charged from PayPal for a standard transaction. Despite its popularity, PayPal may not be the best payment processing solution for every business. If your company is high risk based on the goods or services you offer, it affects the processing fees and your standing in regards to the PayPal User Agreement. Here is a breakdown of the most common Paypal fees that businesses end up having to pay so you can make an informed choice on what payment processor company is best for your business. The bottom line: every transaction is not created equal. If you are considering choosing Paypal as your payment processor, you should understand what Paypal fees you may be charged.

0 kommentar(er)

0 kommentar(er)